This is an excerpt from a blog post from our partner Workday Adaptive Planning. It highlights some approaches for professional services firms to keep up with the breakneck pace of work.

Professional services firms don’t have the luxury of gradually adjusting to an evolving digital environment. For them, the digital future is pretty much here. More than one-third of professional services firms expect that at least 75% of their revenue will come from digital by 2025, according to a report by PwC and Workday.

As an additional sign of the changing times, a growing proportion of firms are investing more than $50 million in artificial intelligence (AI), machine learning (ML), and advanced analytics, according to the report. And with recent advances in generative AI, investments are likely to continue to grow. That’s further blurring the line between professional services and digital services—a distinction that will only get fuzzier in the future.

“Digital first is our new reality. That isn’t going to change,” shared Joe Golden, vice president of services, IBM, at a Workday event.

Yet, despite how adroitly many professional services firms adapted to wide-scale changes brought on by the pandemic, some lack visibility around past behavior and likely future outcomes. “Professional services organizations can be surprisingly opaque when it comes to insight,” IDC reports.

To succeed, firms must solve their data, talent, and technology challenges. But many have yet to embrace this new reality. Among professional services leaders, 57% say there’s a growing gap between where their business is and where it needs to be to compete, according to a recent Workday study on digital transformation. And only 23% say their digital strategy allows them to keep pace with or exceed the demands of the business.

Firms will need to bolster their access to high-quality, always-available data, along with having staff with the necessary data literacy skills to make sense of it all. Of companies with fully-accessible data, 76% say they are well-equipped digitally to ensure business continuity in times of crisis, Workday finds. Small wonder, then, that advanced analytics and data visualization are the skills most sought after by IT leaders (35%) and finance leaders (34%).

“Access to data is the crux of most technology issues in any company,” says Jennifer LaClair, CFO, Ally Financial.

To better understand what the future might hold for professional services firms, industry thought leaders shared their predictions for three of the biggest trends the industry will face. The following excerpt focuses on how professional services firms can benefit from more sophisticated forecasting.

Data Silos Disappear as Organizations Race to Future-Ready Forecasting and Adaptability

To drive productivity and profit and to forecast accurately, future-forward professional services firms will need more integration and less separation of their people and systems. “Today’s professional services organizations simply cannot operate with functional silos as the lines between sales, delivery, and finance become blurred,” SPI asserts.

Unfortunately, these organizations’ data too often sits trapped within silos. “The reason most companies can’t forecast their revenue more accurately is because they have different systems and data across their lines of businesses and services,” Joseph says. “And all those different systems mean that you have data that’s going to be wildly inconsistent.”

Almost half (49%) of business leaders—and almost two-thirds (62%) of professional services leaders—say their inability to connect operational, people, and financial data to business outcomes impairs the organization’s agility, according to a Workday survey of senior business executives.

But firms with accessible data tell a different story, the Workday survey reveals. A towering 85% of leaders whose companies enjoy fully accessible data say the organization can embrace change readily. All of which points to the urgent need to overcome siloed data sources.

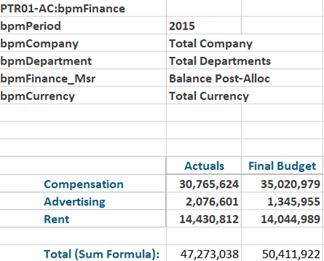

For ERPA, a consulting and enterprise application managed services firm, adopting professional services automation slashed the time needed to calculate revenue from a full day to just 15 minutes. And the firm gained a stronger forecasting ability in the process.

“From week to week, we’re able to get a really good sense of our forecasted revenue for projects in the next four to 12 weeks,” says Jon Milkovich, director of Workday financials at ERPA. “So it’s really provided a lot better real-time insight into what our forecasted revenue will be.”

That’s a need that best-in-class firms are meeting head-on. They’re 82% more likely than other firms to be able to share financial and operational data with the extended enterprise through a central repository, Aberdeen finds in its report: “Leverage Demand Planning and Forecasting for Best-in-Class Performance During Volatile Times.”

Learn more about how professional services firms can adapt and change in our recent webinar, Streamlining Professional Business Services with Workday Adaptive Planning.

Read the full blog post on the Workday blog.

More from our FP&A Done Right Series:

Enterprise Planning Helps Professional Services Firms Adapt to Changes