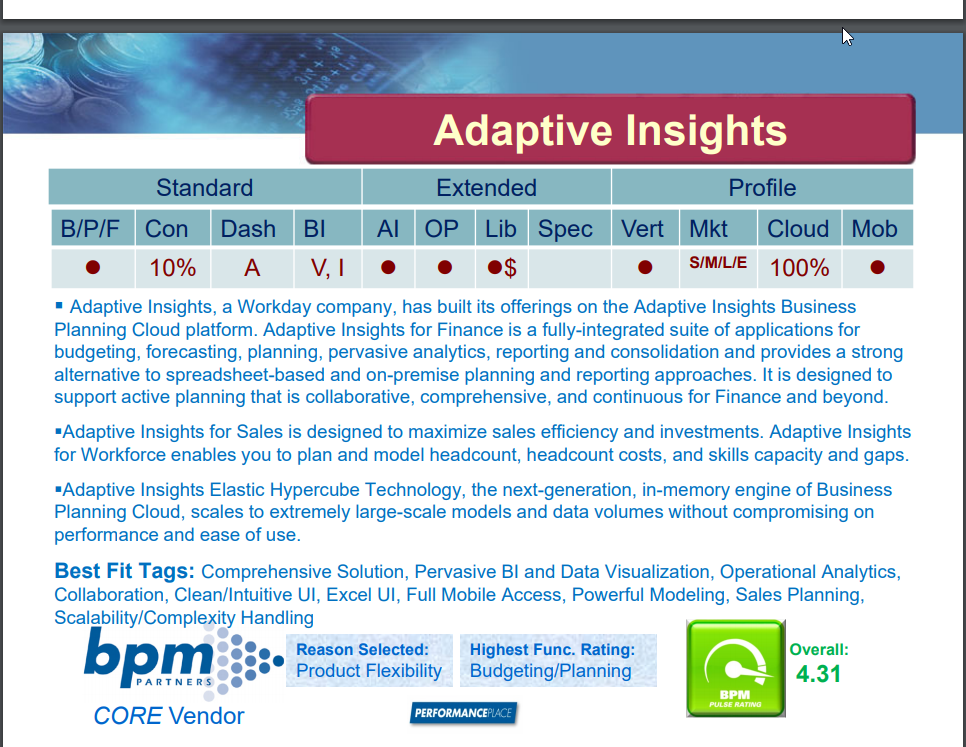

HTML reports are the “bread and butter” of the finance professional. We’ve created a short demo video of how to easily create reports in Adaptive Insights.

In this video, part of our series The Capabilities of Adaptive Insights, Ken DiSessa shows you how to create a variance report looking at a budget versus actuals. He discusses the color coding and icons in Adaptive Insights, how to drill down into details, and the powerful explore cell feature.

Watch Reporting in Adaptive Insights and you’ll learn how to create a new report using filters and parameters.

Did you miss the first video in our series?

Check out Dashboarding in Adaptive Insights.

Learn more about Revelwood and Adaptive Insights:

Revelwood Named Adaptive Insights Partner Rising Star of the Year