In the first part of this two-part blog post, we introduced the key business benefits from replacing traditional, static planning with dynamic agile planning. In this second part, we will be looking at the key practical challenges to implementing agile planning and how to overcome them.

The Key Barriers to Agile Planning

Transitioning to agile planning isn’t simple. Most organizations face three primary challenges:

1. Manual Processes: Many companies still rely heavily on Excel spreadsheets. While spreadsheets are great for certain tasks, they become unwieldy when trying to coordinate planning across an entire organization. Manually aggregating data from many sources, fixing broken formulas, analysing budget submissions, and manually coordinating stakeholder approvals consume enormous amounts of time and effort.

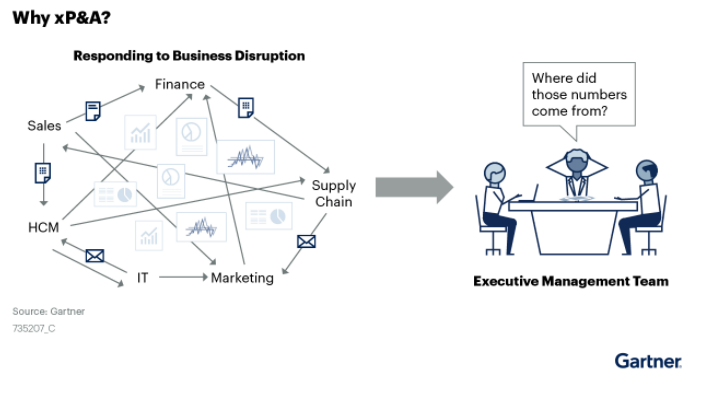

2. Lack of Collaboration: Traditional planning often happens in silos. Sales works separately from operations, operations works independently from HR. This disconnection prevents a holistic view of the business and makes strategic alignment difficult.

3. Disjointed Data: Different departments often use different datasets, leading to conflicting information and slow decision-making. Without a single source of truth, organizations struggle to create coherent plans.

How to Move Towards Agile Planning: A Step-by-Step Guide

1. Assess Your Current Situation

- Understand your existing planning processes

- Identify bottlenecks and inefficiencies

- Map out current technology and data challenges

2. Build Organizational Alignment

- Get senior leadership support

- Create a cross-functional team including finance, operations, sales, HR, and IT

- Develop a clear business case that quantifies the potential impact of agile planning and the key objectives to be achieved

3. Focus on effective driver-based planning

- Identify key interrelationships and shared drivers and KPIs between different business functions

- Build processes and models that reflect those interdependencies and support the use of shared assumptions and KPIs

- Where feasible, replace manual inputs with driver-based calculated outputs enabling faster forecasting and scenario analysis

- Assign a suitable owner to every key input and output of the planning process

- Ask budget holders to plan to use the KPIs and metrics that they recognise, can control and therefore can forecast.

4. Prioritise user experience over complexity

- Focus on key business drivers rather than overly complex models with highly granular input requirements

- Provide flexibility to add more detail when desired or required

- Challenge the value of additional modelling complexity

5. Leverage Technology

Remove dependence on spreadsheet-based planning processes and invest in a modern planning solution that offers:

- Automated data integration

- Collaborative planning tools offering an intuitive user experience

- Scenario modelling capabilities

- Flexible and accessible self-service reporting offering real-time insights

6. Foster a Culture of Continuous Planning & Continuous Improvement

- Encourage regular communication across departments

- Make planning an ongoing, dynamic process

- Regularly evaluate the accuracy of planning outputs

- Identify and implement improvements to the planning process and models to reduce any recurring variances

The Future of Planning

The businesses that will succeed in the coming years are those that can plan with speed and flexibility. As the saying goes, “Change has never been this fast, and it will never be this slow again.”

Agile planning isn’t just a trend—it’s a fundamental shift in how businesses operate. It transforms finance from a reporting and governance function to a strategic partner that drives business innovation.

Final Thoughts

Transitioning to agile planning is a journey. It requires investment in technology, a shift in organizational culture, and a commitment to continuous improvement. But for businesses looking to stay competitive in an increasingly unpredictable world, it’s not just an option — it’s a necessity.

The companies that master agile planning will be able to quickly identify opportunities, mitigate risks and turn uncertainty into a competitive advantage.

Are you ready to make the shift?

More from our FP&A Done Right Series:

The Hidden Value of Strategic Planning: Gaining Operational Efficiencies

Budgeting That Works: How to Plan for Success in an Uncertain World

10 Steps to Transform Financial Planning & Analysis: A Guide to a Successful FP&A Implementation